The Car Accident Claims Process: As a policyholder, I know how vital it is to understand the car accident claims process. It helps ensure a smooth experience. The process can be complex and take a lot of time. But, with the right help, it can be much easier.

It’s key to know your rights and the steps in filing a claim. The type of coverage in your insurance policy and state laws are important. They affect how your claim is handled. Knowing the process helps you get the compensation you deserve.

The claims process can feel overwhelming. But, with the right info, you can get through it. In this article, I’ll give you a detailed guide. It will help you understand the car accident claims process and ensure you get the compensation you deserve.

Table of Contents

The Car Accident Claims Process: Key Takeaways

- Understanding your insurance policy is crucial in the car accident claims process

- Knowing your rights and the claims process can make a significant difference in the outcome of your claim

- The car accident claims process involves reporting the accident to your insurance company and working with claims adjusters

- State-specific insurance requirements and insurance policy coverage types play a crucial role in determining the outcome of your claim

- A smooth claims process requires the right guidance and information

- The car accident claims process can be complex and time-consuming, but having the right guidance can make it easier to navigate

Understanding Your Rights as a Policyholder

As a policyholder, knowing your rights is key. You need to understand the different insurance coverages out there. This knowledge helps you make smart choices and get the compensation you deserve. The National Association of Insurance Commissioners (NAIC) offers great info on insurance rules and your rights, which is very helpful.

There are many types of insurance coverage to look at. These include liability, collision, and comprehensive. Each has its benefits and limits. Knowing these differences is important for choosing the right coverage for you. Also, state-specific requirements can change, so it’s good to know the laws in your area.

Important policyholder rights include fair claims settlement, the right to appeal, and the right to cancel. It’s also crucial to understand your insurance coverage options. Make sure to review your policy often to see if it still fits your needs. Being informed and active in managing your insurance helps protect you and your family from financial loss.

When reviewing your insurance coverage, consider these points:

- Understanding your deductible and premium payments

- Knowing your coverage limits and exclusions

- Familiarizing yourself with the claims process and state-specific requirements

By understanding your policyholder rights and insurance coverage options, you can make better decisions. This ensures you’re protected in case of accidents or unexpected events.

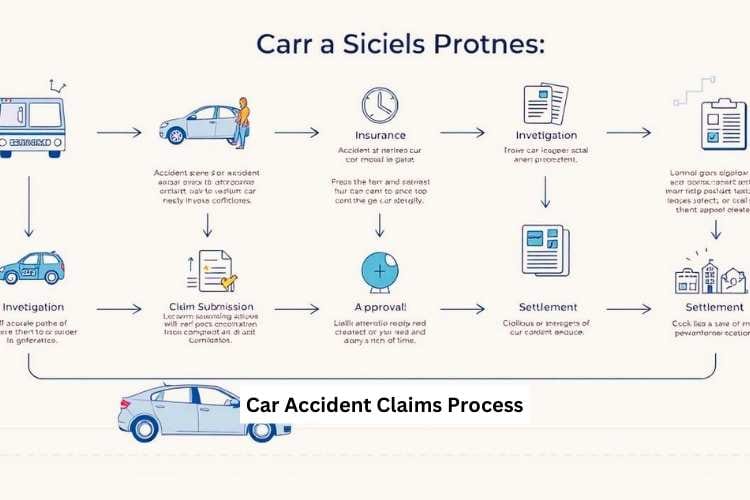

The Car Accident Claims Process: A Guide for Policyholders

As a policyholder, knowing the claims process is key. The Insurance Information Institute (III) offers guidance on this. They stress the need to report accidents quickly and provide all needed info. When you report an accident, you’ll need to give details like the date, time, and where it happened. You’ll also need to share info about any other people involved.

The claims process can be tricky, but claims adjusters can help. They look into the accident, figure out the damage, and talk about settlements. It’s important to work well with claims adjusters and give them all the info they need.

Reporting the Accident to Your Insurance Company

- Contact your insurance company as soon as possible after the accident

- Provide detailed information about the incident, including the date, time, and location

- Share information about any other parties involved, including their insurance information

Working with Claims Adjusters

Claims adjusters will help you through the claims process. They make sure you get fair compensation for your damages. To work well with them, be ready to give lots of details about the accident and your damages. This might include photos, witness statements, and repair estimates.

Timeline Expectations and Deadlines

Knowing the timeline and deadlines for the claims process is important. It helps you get compensation on time. Make sure to ask your claims adjuster about any deadlines for filing a claim or providing more info. By following these steps and working closely with claims adjusters, you can smoothly navigate the claims process. This way, you’ll get the compensation you deserve.

Building a Strong Insurance Claim

As a policyholder, I know how vital it is to build a strong insurance claim. The American Bar Association (ABA) says gathering evidence and documentation is key. I start by collecting important evidence like police reports, medical records, and witness statements.

For documentation, I keep detailed records of my losses. This includes receipts, invoices, and repair or replacement estimates. The ABA stresses the need to document all communication with the insurance company. This includes dates, times, and conversation details.

Some key steps to building a strong insurance claim include:

- Gathering evidence and documentation to support my claim

- Keeping detailed records of my losses and expenses

- Presentation of my claim to the insurance company in a clear and concise manner

- Negotiating with the insurance company to ensure a fair settlement

By following these steps and working with my insurance company, I can build a strong insurance claim.

Remember, building a strong insurance claim takes patience, persistence, and attention to detail. By staying organized and focused, I can ensure my claim is processed efficiently. This way, I get the fair compensation I deserve.

Conclusion

When dealing with car accident claims, it’s important to know how to get the most out of your claim. This article has given you tips to help you succeed. By following these steps, you can make your claims process smoother and more successful.

Being organized and proactive is crucial. Keep good records of the accident, and your injuries, and talk with your insurance. Also, think about getting help from a personal injury attorney. They can fight for your rights and guide you through the claims process.

Use the advice from the National Association of Insurance Commissioners (NAIC) and the Insurance Information Institute (III) to your advantage. This way, you can maximize your claim success and get the full compensation you deserve. Remember, you have rights. With the right steps, you can get a good outcome for your car accident claim.

Bhakti Rawat is a Founder & Writer of InsureMyCar360.com. This site Provides You with Information Related To the Best Auto Insurance Updates & comparisons. 🔗