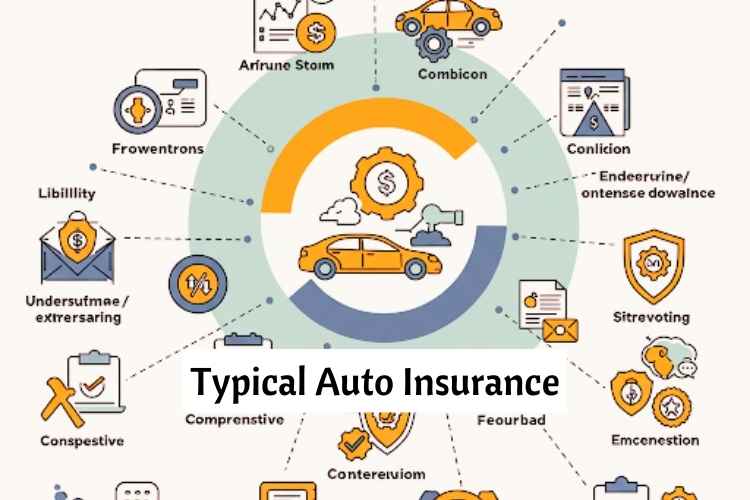

Typical Auto Insurance Coverage: Auto insurance is more than just a legal requirement—it’s a vital financial safeguard. In 2025, with rising premiums and evolving technologies, understanding your coverage options is crucial. This guide breaks down the essentials of auto insurance, helping you make informed decisions tailored to your needs.

Table of Contents

Typical Auto Insurance Coverage: Key Types of Auto Insurance Coverage

| Section | Subtopics Covered | Key Elements |

|---|---|---|

| 1. Typical Auto Insurance | – Importance of auto insurance – Why this guide matters in 2025 | – Warm, conversational tone – Brief overview of what auto insurance is and why it’s critical today – Mention of rising repair costs, changing laws, and increased car ownership |

| 2. What is Auto Insurance? | – Basic definition – Legal requirement – How it works | – Simple explanation of policyholder, premium, deductible, and claim process – Example scenario of an accident and insurance coverage |

| 3. Types of Auto Insurance Coverage | – Liability coverage – Collision coverage – Comprehensive coverage – Personal Injury Protection (PIP) – Uninsured/Underinsured Motorist coverage | – Each type broken down clearly – Real-life examples for each (e.g., deer hit, storm damage, theft) – Notes on what is optional vs. mandatory in different states |

| 4. Optional Add-ons (Riders) | – Gap insurance – Roadside assistance – Rental reimbursement – Custom equipment coverage | – Description and purpose of each – When it’s worth it (e.g., new car buyers may want gap insurance) |

| 5. How Premiums are Calculated | – Factors influencing cost – Driver profile, location, vehicle type, driving history | – Realistic examples: Teen driver vs. adult – 2025 average premiums in U.S. (e.g., $1,700/year nationally) – Tips on lowering premiums |

| 6. State-by-State Variations | – Minimum required coverage – No-fault vs. at-fault states | – 2025 legal requirements for key states (CA, TX, NY, FL) – Simple map or chart representation – Why knowing your state law matters |

| 7. Claim Process Explained | – Filing a claim – Adjuster role – Repair and settlement process | – Step-by-step claim example (rear-end collision) – What to do immediately after an accident – Tips to avoid denied claims |

| 8. Common Mistakes to Avoid | – Letting coverage lapse – Underinsuring – Skipping optional but vital coverages | – Expert insights and red-flag warnings – Example of a denied claim due to lapse in payment |

| 9. 2025 Trends in Auto Insurance | – Telematics & usage-based insurance – AI in claim processing – EV coverage considerations | – Each type is broken down clearly – Real-life examples for each (e.g., deer hit, storm damage, theft) – Notes on what is optional vs. mandatory in different states |

| 10. Real-World Case Studies | – Two to three brief stories from drivers | – Case 1: Theft recovery – Case 2: Major collision – Case 3: Denied claim and lesson learned |

| 11. Expert Opinions | – Quotes from insurance experts, industry analysts, and agents | – Credibility via source citations (e.g., Insurance Information Institute, J.D. Power) – Insights into smart coverage choices |

| 12. Frequently Asked Questions | – Emerging technology integration – Insurer examples using apps (e.g., Progressive Snapshot) – Specialised coverage needs for electric vehicles | – Concise, clear answers – Based on current market data and consumer satisfaction scores |

| 13. Conclusion on Typical Auto Insurance | – Summary of key takeaways – Encouragement to review and update policies | – How much insurance do I need? – Is full coverage worth it? – What’s the best insurer in 2025? |

Bhakti Rawat is a Founder & Writer of InsureMyCar360.com. This site Provides You with Information Related To the Best Auto Insurance Updates & comparisons. 🔗